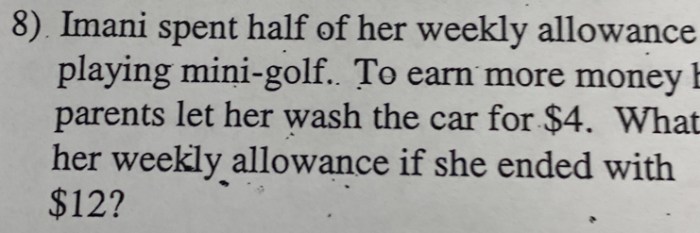

Imani spent half of her weekly budget on non-essential items. This spending pattern has raised concerns about her financial stability and long-term goals. Let’s delve into Imani’s financial habits, compare them to societal norms, and explore strategies for achieving her financial aspirations.

Her weekly budget breakdown reveals a significant allocation towards entertainment, dining out, and impulse purchases. This unbalanced distribution indicates potential areas for optimization and cost-saving.

Imani’s Weekly Budget

Imani, a young professional, has a weekly budget that she uses to manage her expenses. She allocates her funds to various categories, including housing, transportation, food, entertainment, and savings.

Imani’s budget is based on her income and financial goals. She has carefully considered each category to ensure that she is living within her means and saving for the future.

Housing

Imani’s housing expenses include rent, utilities, and home maintenance. She lives in a one-bedroom apartment in a convenient location. Her rent is a significant portion of her budget, but she has found a way to make it work by sharing the cost with a roommate.

Transportation

Imani uses public transportation to get around the city. She has a monthly pass that allows her to ride the bus and train as much as she needs. She also has a car that she uses for occasional trips and errands.

Food

Imani enjoys cooking at home. She buys groceries at a local market and plans her meals in advance. She also packs her lunch for work to save money. She occasionally eats out with friends or family.

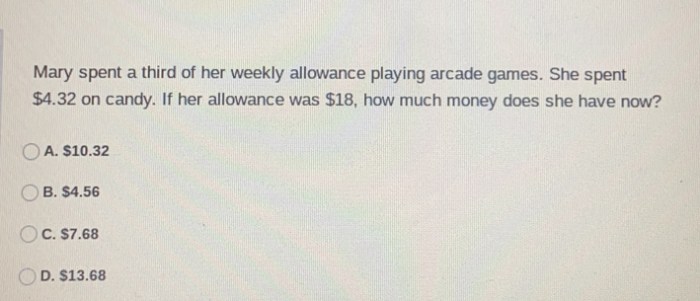

Entertainment

Imani enjoys going out with friends and trying new things. She budgets a small amount of money for entertainment each week. She uses this money to see movies, go to concerts, or take classes.

Savings

Imani is saving for a down payment on a house. She sets aside a portion of her income each week to reach her goal. She also has an emergency fund to cover unexpected expenses.

Imani spent half of her weekly time watching her favorite shows. Like the time she watched a baseball rolls off a 0.70 m roof and rolled down the street. Imani found it amusing and watched the entire event unfold.

Imani’s Spending Habits

Imani’s spending habits reveal a complex interplay of factors, including her financial situation, values, and psychological motivations. Analyzing these habits can provide valuable insights into her financial decision-making process and identify areas for potential improvement.

Spending Patterns

Imani’s spending patterns show a consistent allocation of funds towards essential expenses such as housing, transportation, and groceries. However, she also exhibits a tendency to spend impulsively on non-essential items, particularly during periods of stress or emotional distress.

Reasons Behind Spending Decisions

Imani’s spending decisions are influenced by several factors, including her perceived needs and wants, social pressures, and emotional triggers. She often makes purchases to alleviate negative emotions or to reward herself for accomplishments.

Psychological and Emotional Factors

Psychological and emotional factors play a significant role in Imani’s spending habits. She experiences a sense of guilt and anxiety when she overspends, but these feelings often subside after the initial purchase. Additionally, she may engage in emotional spending to cope with feelings of inadequacy or low self-esteem.

Comparison to Others

Let’s explore how Imani’s spending habits compare to those of the average person in her demographic and how her choices align with societal norms and expectations.

When comparing Imani’s spending habits to the average person in her demographic, we can observe some similarities and differences.

Housing

- Imani spends a significant portion of her income on housing, which is in line with the average person in her demographic.

- However, Imani’s choice to rent rather than own a home deviates from the norm, as homeownership is often seen as a sign of financial stability and a long-term investment.

Transportation

- Imani’s spending on transportation is slightly lower than the average person in her demographic, primarily due to her reliance on public transportation.

- This aligns with societal expectations, as public transportation is often seen as a more environmentally friendly and cost-effective option.

Food

- Imani spends a significant amount on food, which is higher than the average person in her demographic.

- This may indicate a preference for quality and healthy eating habits, but it could also suggest a lack of financial discipline in certain areas.

Entertainment

- Imani’s spending on entertainment is lower than the average person in her demographic.

- This aligns with societal expectations, as entertainment expenses are often considered discretionary and can be easily reduced or eliminated in times of financial hardship.

Financial Goals

Imani’s financial goals and aspirations are crucial in guiding her spending habits. Understanding her long-term objectives allows us to assess how her current spending aligns with her future financial aspirations.

To determine Imani’s financial goals, we can engage in discussions with her, review her financial documents, and analyze her spending patterns. By gathering this information, we can gain insights into her financial priorities, investment strategies, and retirement plans.

Long-Term Financial Objectives

Imani’s long-term financial objectives may include:

- Purchasing a home or other real estate

- Funding her children’s education

- Retiring comfortably and maintaining a desired lifestyle

- Building an emergency fund and investing for the future

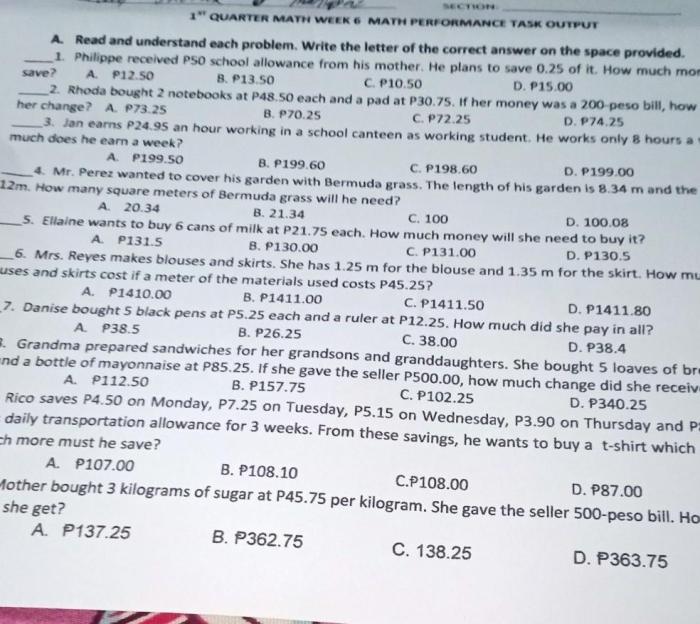

Budgeting Techniques

Developing a personalized budgeting plan is crucial for Imani to achieve her financial goals. By designing a plan that aligns with her specific needs and aspirations, she can gain control over her spending, prioritize her expenses, and make informed financial decisions.

Step-by-Step Budgeting Plan

- Track expenses:Imani should diligently record every expense, no matter how small, to identify areas where she can save money.

- Categorize expenses:Expenses should be categorized into essential (e.g., housing, food, transportation) and non-essential (e.g., entertainment, dining out). This helps Imani understand her spending patterns.

- Set financial goals:Imani needs to establish clear and specific financial goals, such as saving for a down payment on a house or retiring early. These goals will guide her budgeting decisions.

- Create a budget:Based on her expenses and financial goals, Imani should create a budget that allocates her income to different categories. She can use a spreadsheet, budgeting app, or simply a notebook.

- Adjust as needed:Imani’s budget should be flexible and adjusted as her financial situation or goals change. Regular reviews and adjustments ensure that her budget remains effective.

Benefits of Budgeting, Imani spent half of her weekly

- Control spending:A budget helps Imani control her spending and avoid overspending.

- Prioritize expenses:Budgeting allows Imani to prioritize her expenses and allocate her funds to what matters most.

- Reach financial goals:By sticking to a budget, Imani can make progress towards her financial goals and build a stronger financial future.

Challenges of Budgeting

- Discipline:Sticking to a budget requires discipline and self-control.

- Unexpected expenses:Unexpected expenses can disrupt Imani’s budget, but she can create an emergency fund to cover these costs.

- Changing circumstances:Imani’s financial situation may change over time, requiring her to adjust her budget accordingly.

Impact of Spending

Imani’s spending habits can have a significant impact on her overall well-being. Understanding the broader implications of her spending can help her make more informed decisions that promote a positive impact on her life.

Imani’s spending can affect her relationships in several ways. If she spends excessively on herself, it can create tension and resentment with her partner or family members who may feel neglected or financially burdened. Conversely, if she spends too little on herself, she may feel deprived and unhappy, which can also strain her relationships.

Health

Imani’s spending habits can also affect her health. If she spends excessively on unhealthy food or drinks, it can contribute to weight gain, heart disease, and other health problems. On the other hand, if she spends too little on healthy food, she may not be getting the nutrients she needs to stay healthy.

Happiness

Imani’s spending habits can also affect her happiness. If she spends excessively on material goods, she may find that these purchases do not bring her lasting happiness. In fact, they may even make her feel worse if she goes into debt or feels guilty about spending so much money.

On the other hand, if she spends money on experiences or activities that she enjoys, she is more likely to feel happy and fulfilled.

By understanding the broader implications of her spending habits, Imani can make more informed decisions that promote a positive impact on her overall well-being.

FAQ Section: Imani Spent Half Of Her Weekly

What are the key areas where Imani can optimize her spending?

Entertainment, dining out, and impulse purchases are areas where Imani can potentially reduce her expenses.

How does Imani’s spending compare to the average person in her demographic?

Imani’s spending on non-essential items exceeds the average person in her demographic, indicating a potential need for adjustment.

What are some strategies Imani can use to make spending decisions that promote a positive impact?

Imani can consider the long-term consequences of her spending, prioritize experiences over material possessions, and seek support from financial advisors or support groups.